Can Anyone Crack ASML’s Grip on the Lithography Market?

- 16.03.2025 17:02

- thedailyupside.com

- Keywords: danger, success

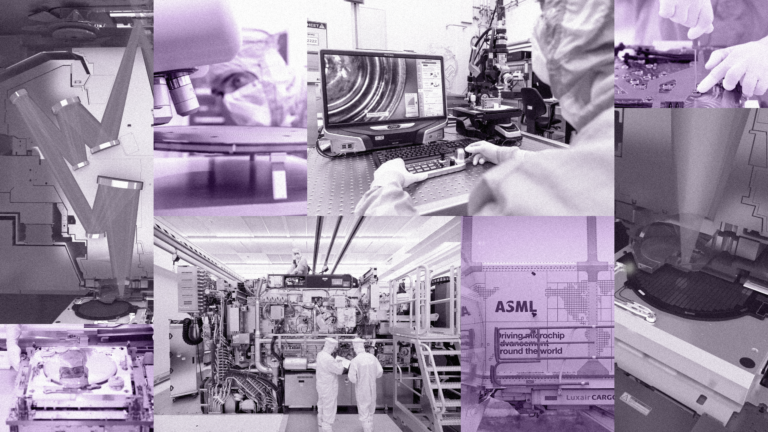

ASML dominates the semiconductor lithography market but faces challenges from geopolitical tensions and fluctuating earnings, despite its crucial role in producing advanced chips for global tech products.