Metal Stock Updates today: Tata Steel, JSW, SAIL, Other Steel Stocks Rise Up To 7% As DGTR Recommends 12% Safeguard Duty

- 19.03.2025 05:46

- news18.com

- Keywords: danger, success

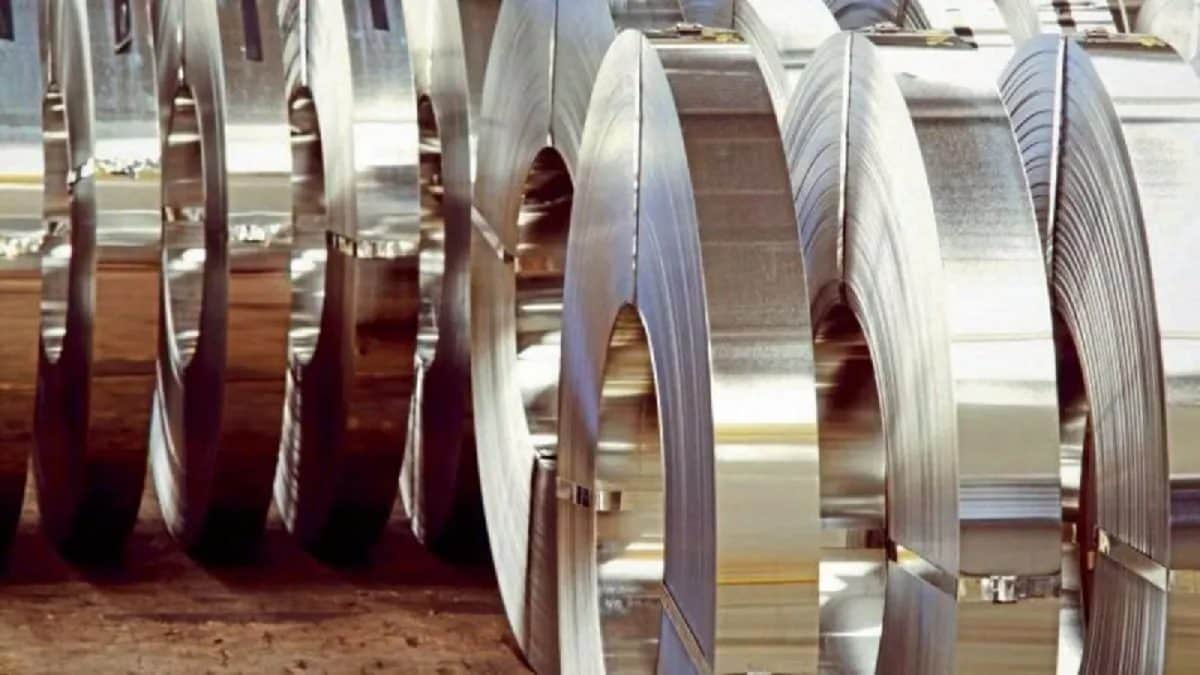

Steel stocks such as Tata Steel and SAIL gained up to 7% after the DGTR recommended a 12% safeguard duty on steel imports. Analysts predict this could enhance sector profitability, with JP Morgan highlighting positive implications for Indian steelmakers.