Nvidia CEO says company has not been asked to buy a stake in Intel

- 19.03.2025 21:00

- channelnewsasia.com

- Keywords: Nvidia

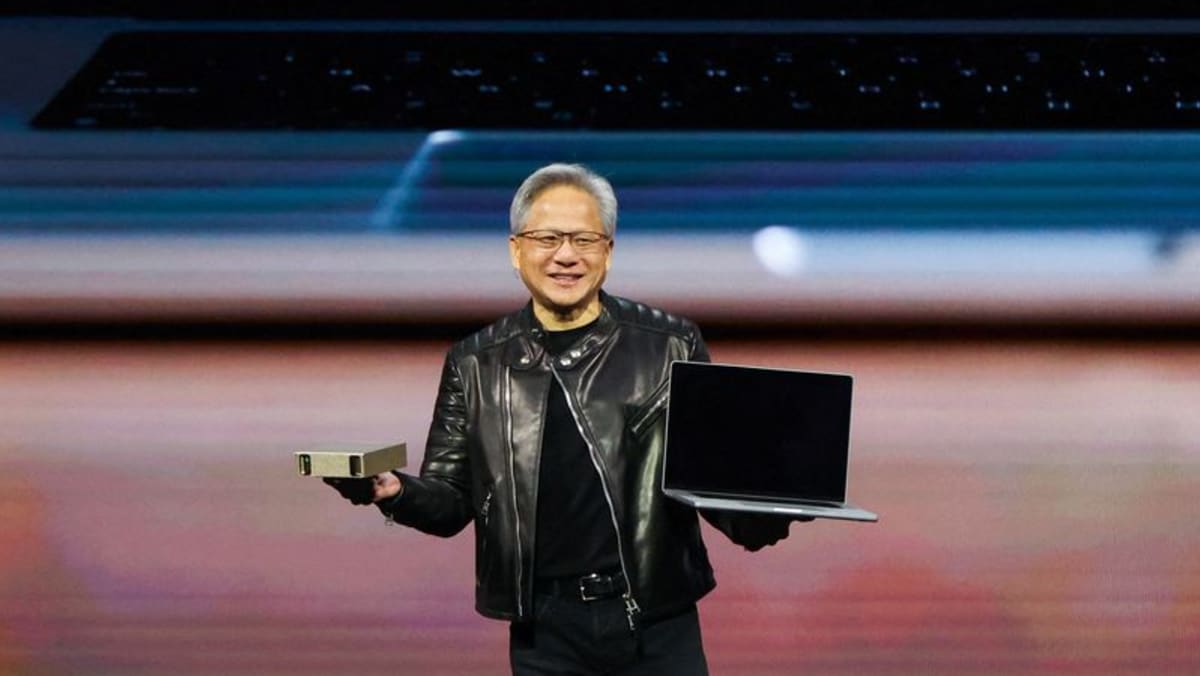

Nvidia CEO Jensen Huang stated the company hasn't been approached to buy a stake in Intel, despite reports of TSMC considering a joint venture with other firms. Meta plans to use Nvidia's Blackwell chips for AI training, reflecting broader tech investments in AI infrastructure.