Google, Meta set to benefit as India proposes to scrap equalisation levy from April 1

- 25.03.2025 05:24

- fortuneindia.com

- Keywords: Google

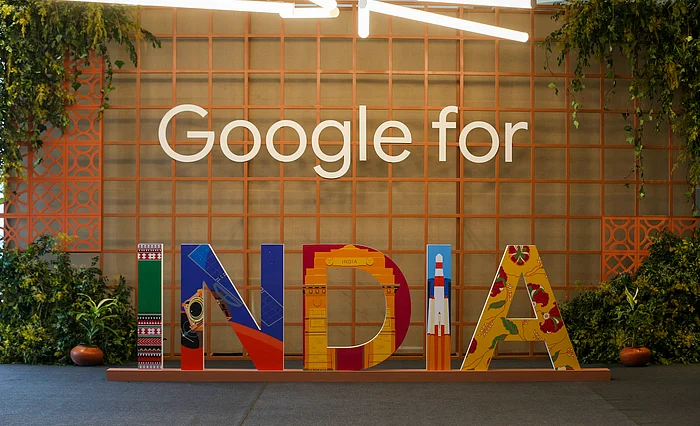

India scraps a 6% equalisation levy on Google and Meta from April 1, 2025, simplifying tax laws and aligning with international standards for online advertising services.