Tesla Stock Rebounds: Here’s What Daniel Ives Predicts Ahead

- 25.03.2025 06:20

- markets.businessinsider.com

- Keywords: Stock Market, Tesla

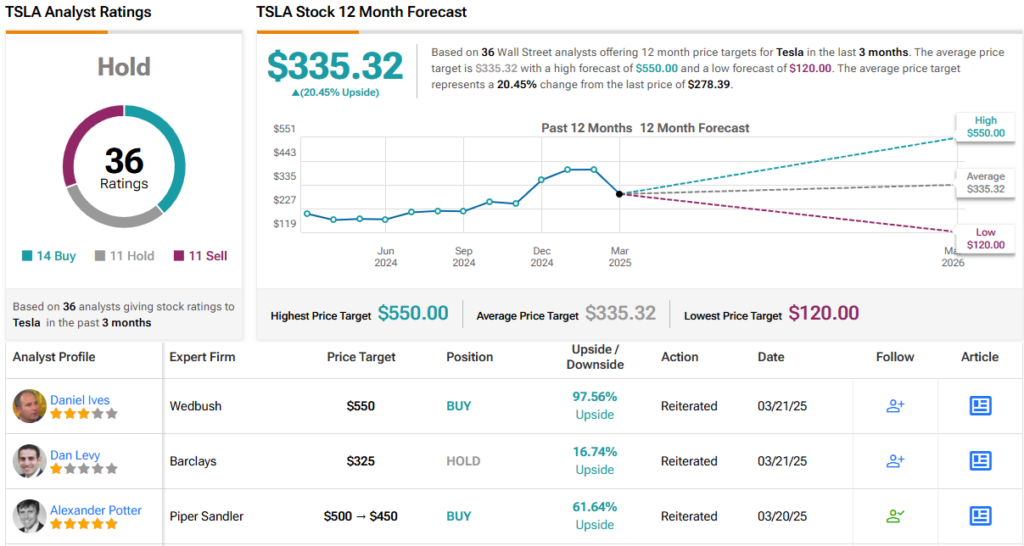

Tesla shares are rebounding as CEO Elon Musk addresses internal concerns in a rare all-hands meeting. Analyst Daniel Ives predicts strong growth, driven by upcoming products like the Cybercab and Model Y, with a $550 price target for Tesla stock.