IN FOCUS: With people turning to social media for financial guidance, what is the role of finfluencers?

- 25.03.2025 18:46

- channelnewsasia.com

- Keywords: finfluencers, Chocolate Finance

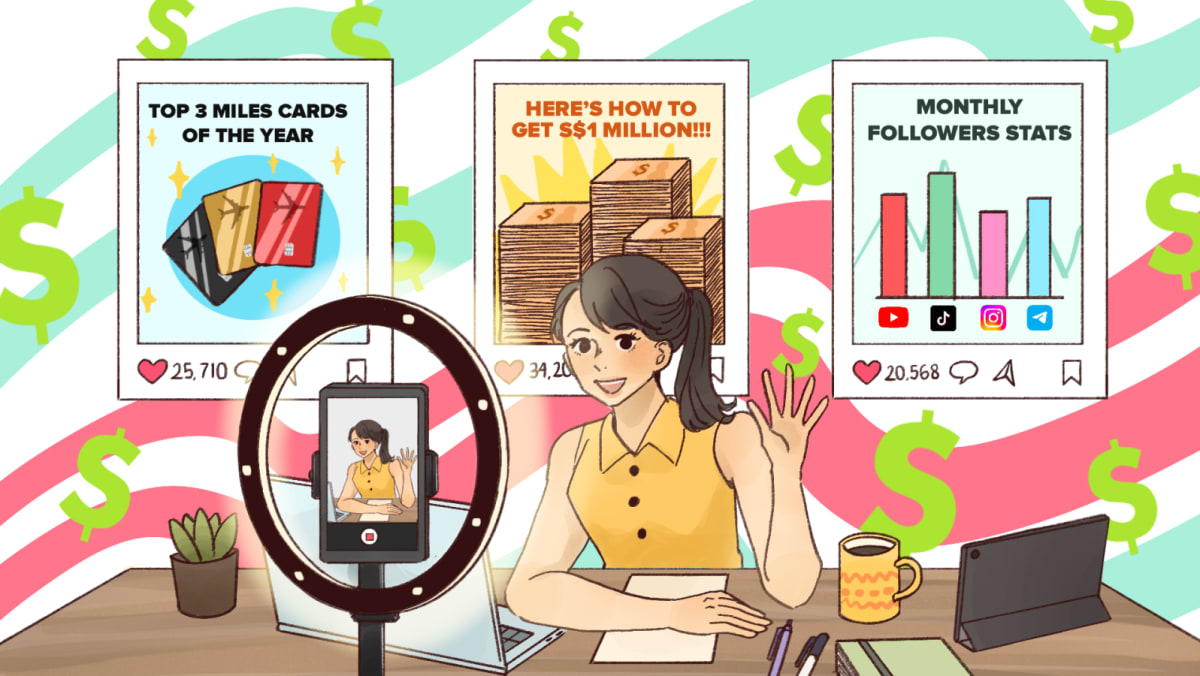

Financial influencers, or "finfluencers," have gained popularity on social media as people seek financial advice online. They create engaging content to share tips and build trust with audiences, often using relatable examples. However, concerns about accuracy and potential risks have emerged, especially after incidents like the Chocolate Finance saga.