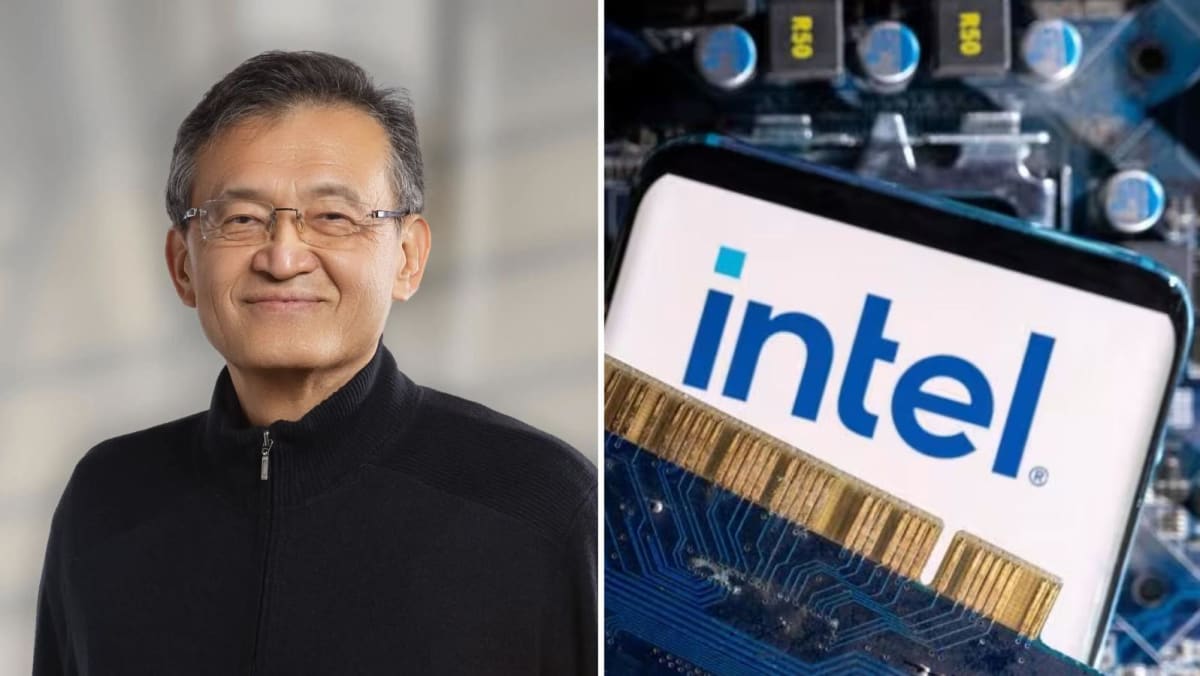

Who is Tan Lip-Bu, the Singapore-raised tech titan tasked with steering Intel's comeback?

- 6 hours ago

- channelnewsasia.com

- Keywords: Tan Lip-Bu, Intel

Tan Lip-Bu, a Singapore-born tech leader, is the new CEO of Intel, tasked with reviving the company's fortunes. With a strong background in semiconductors and venture capital, he brings industry expertise to address Intel's challenges in the chipmaking sector.