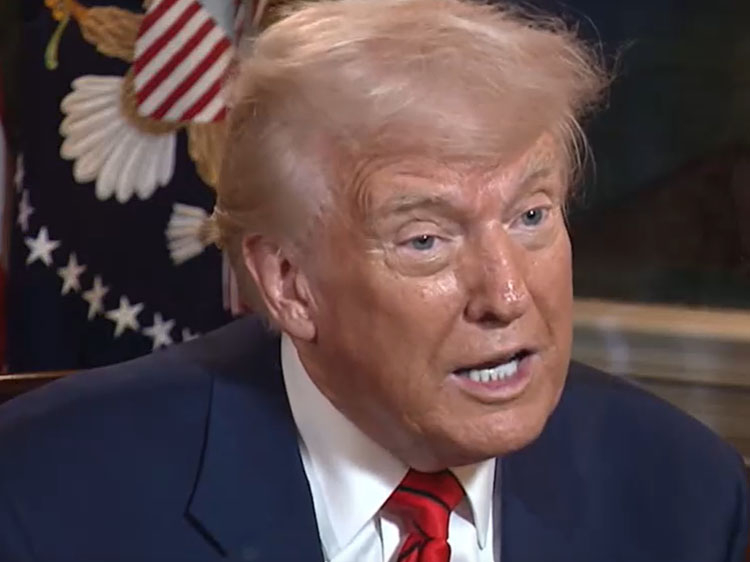

Trump on Tariffs: "The Real Business People Are Loving It"

- 17.03.2025 00:09

- realclearpolitics.com

- Keywords: tariffs, trade policy

President Trump discussed his tariff policies with Canada, highlighting unfair trade practices like 270% dairy tariffs. He imposed tariffs on steel and aluminum to address these issues, expecting increased business investment and job creation in the U.S.