‘Load Up the Truck,’ Says Top Investor About Tesla Stock

- 16.03.2025 18:49

- markets.businessinsider.com

- Keywords: Tesla, Investor Sentiment, Electric Vehicle

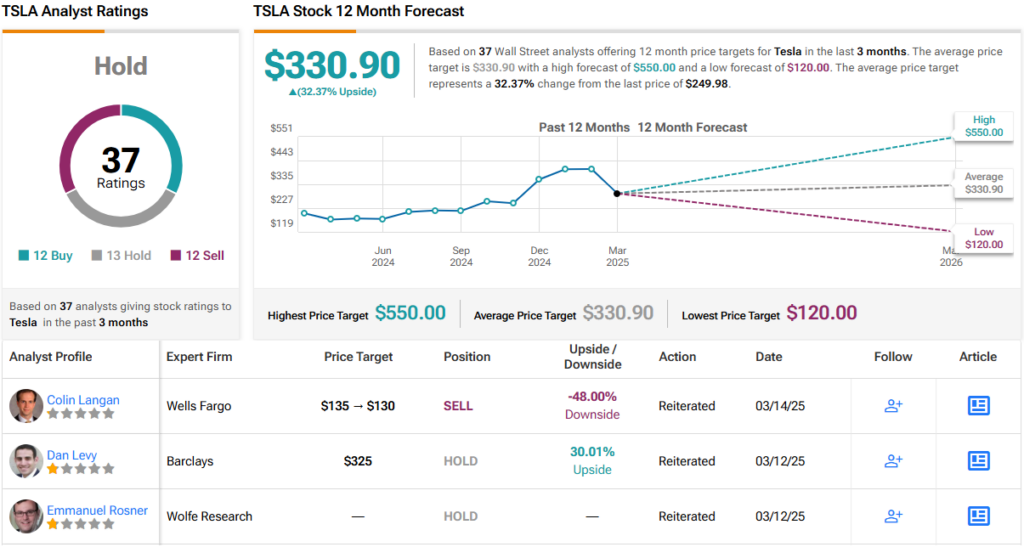

A top investor advises loading up on Tesla stock, viewing recent declines as temporary despite political risks and weak sales. Despite Wall Street's mixed outlook, the investor highlights Tesla's growth prospects and profitability, suggesting long-term potential.