Super Micro Computer Stock’s (SMCI) Technical Indicators Signal a “Buy”

- 17.03.2025 13:35

- markets.businessinsider.com

- Keywords: AI, Growth

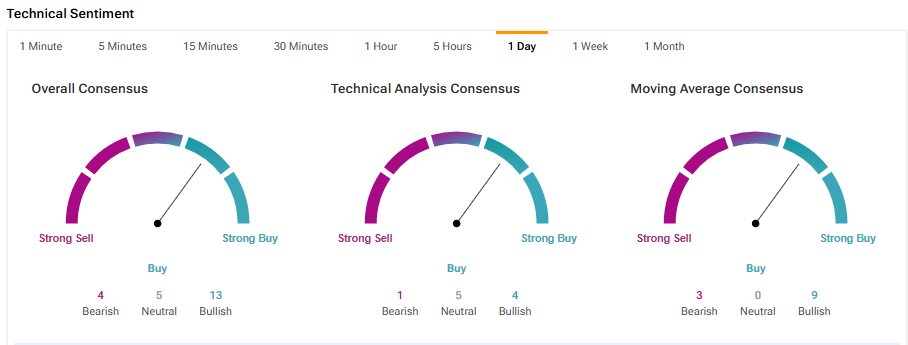

Super Micro Computer (SMCI) stock is up 38% YTD due to strong demand for its AI servers and partnerships. Technical indicators like MACD and Williams %R suggest a buy signal, while Wall Street's Hold rating indicates potential upside to $50.50.