Apple Pay expands to Puerto Rico

- 19.03.2025 03:31

- appleinsider.com

- Keywords: danger, success

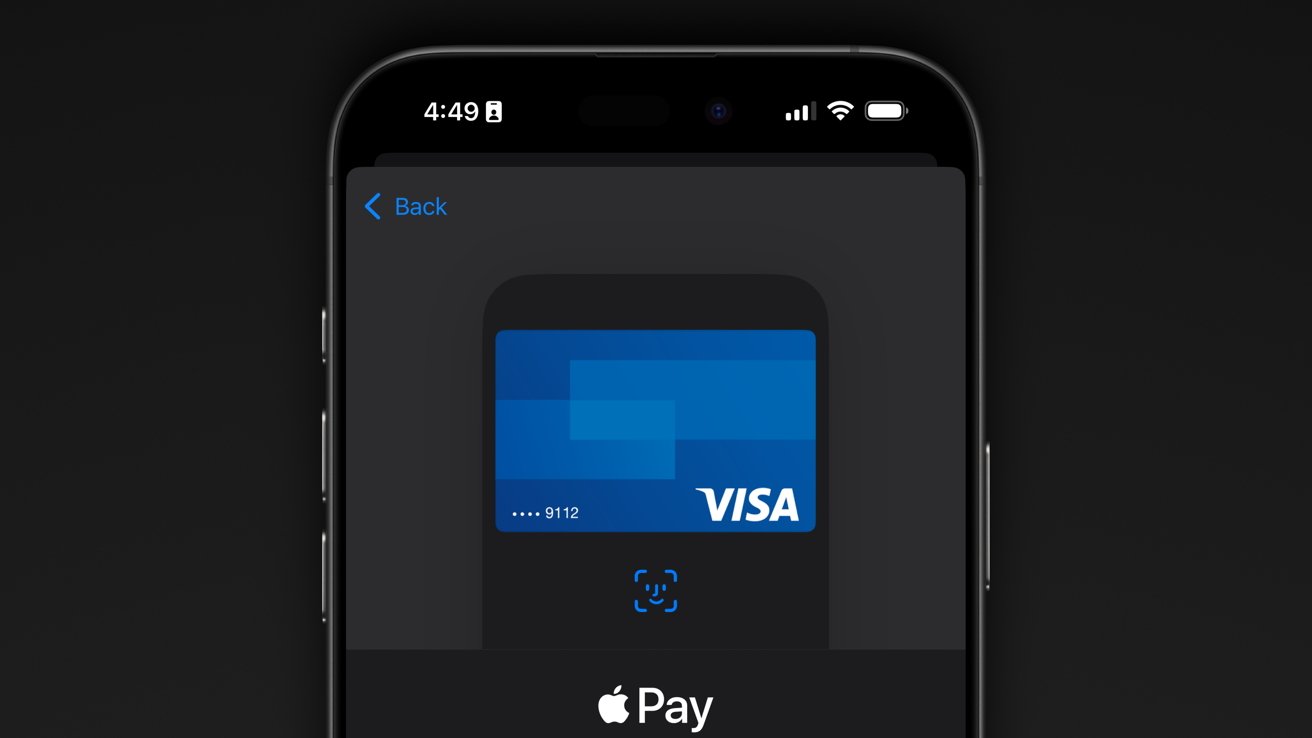

Apple Pay is now available in Puerto Rico after Banco Popular began supporting it, offering residents a new way to make contactless payments. The expansion follows years of effort by Apple to increase merchant adoption and consumer understanding of the service.