Data center capacity soaring, along with investment and land use

- 19.03.2025 08:13

- pv-magazine.com

- Keywords: Data Center Growth, Electricity Demand, Artificial Intelligence, Market Expansion, Renewable Energy, Land Use

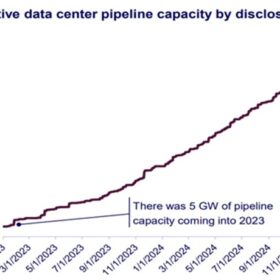

Data center capacity in the U.S. has surged, reaching over 92 GW by late 2024, driven by AI adoption and high electricity demand. Companies like Amazon and Meta are investing heavily in large-scale solar projects to offset their power usage, with data centers requiring significant land and infrastructure.