Nvidia CEO says orders for 3.6 million Blackwell GPUs exclude Meta

- 20.03.2025 02:52

- telecom.economictimes.indiatimes.com

- Keywords: AI, Market Growth

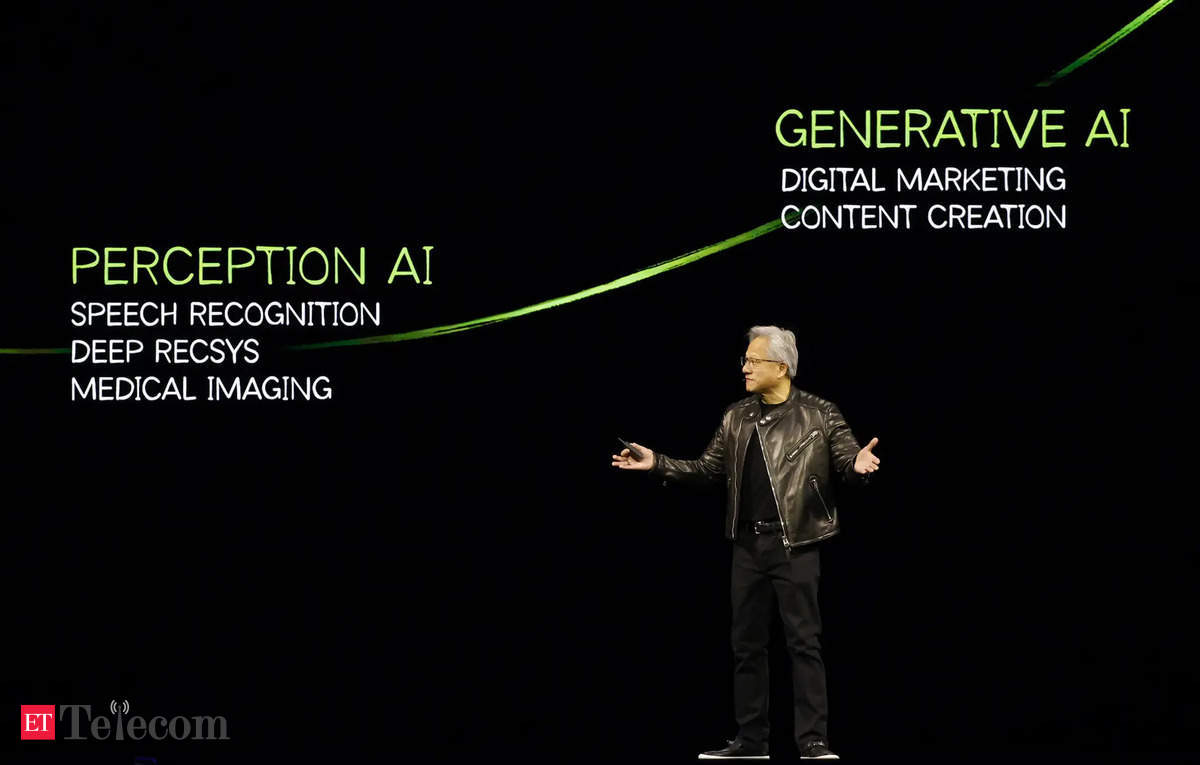

Nvidia CEO Jensen Huang stated that orders for 3.6 million Blackwell GPUs exclude major customers like Meta and internet service providers. He emphasized strong demand despite competition in AI chips.