Nvidia Will Transform From Chip Maker to 'AI Factory:' Jensen Huang Outlines Company's Future

- 20.03.2025 07:10

- techtimes.com

- Keywords: danger, danger

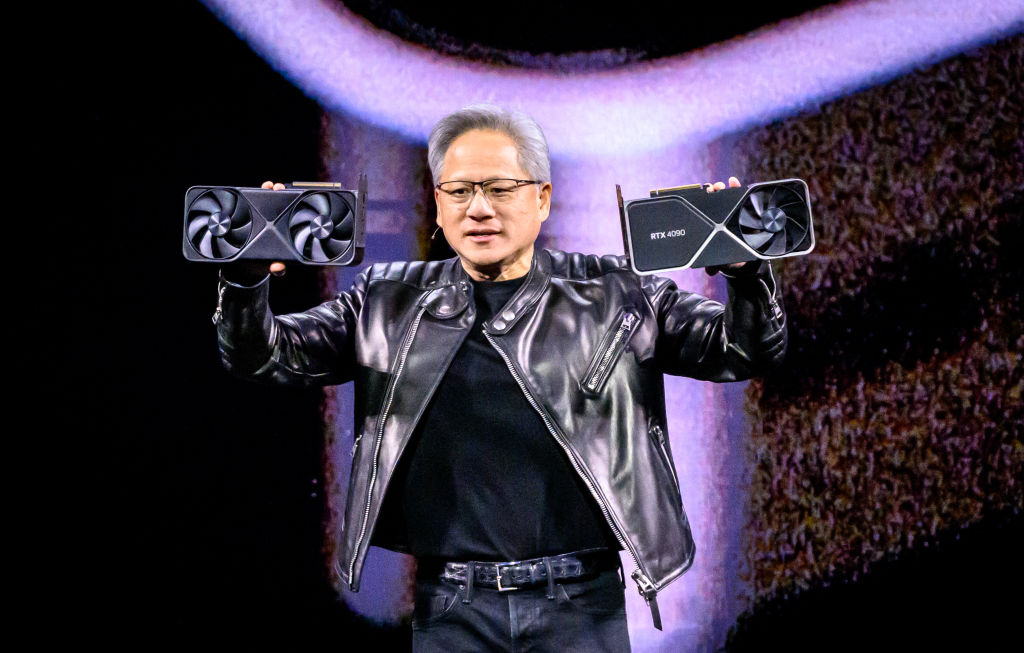

Nvidia CEO Jensen Huang announced the company's shift from being a chip maker to an AI infrastructure provider, unveiling four new GPU architectures for future AI innovation and highlighting record sales of AI GPUs to cloud providers while addressing supply chain challenges.