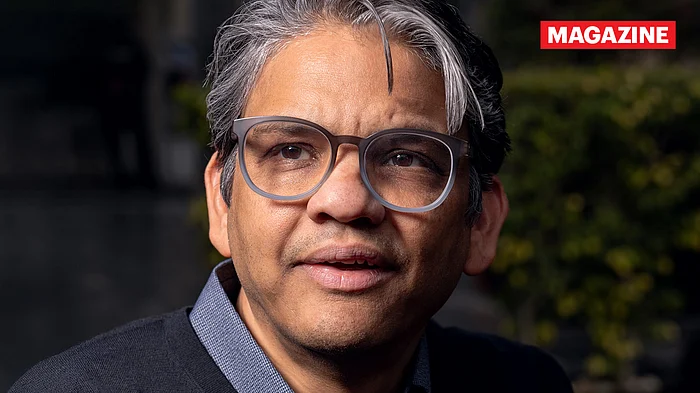

Francisco D’Souza’s next big bet: Backing the future giants of tech with Recognize

- 22.03.2025 00:00

- fortuneindia.com

- Keywords: AI, Private Equity

Francisco D’Souza, former CEO of Cognizant, now leads Recognize, a private equity firm focusing on digital services investments. His extensive industry experience enables him to identify high-potential startups in areas like cybersecurity and cloud computing, aiming to build the next wave of global tech giants.