Global Sales Of Infotainment Systems For Passenger Vehicles Reach 105 MN Annually: Report

- 24.03.2025 11:14

- timesnownews.com

- Keywords: dangerous, success

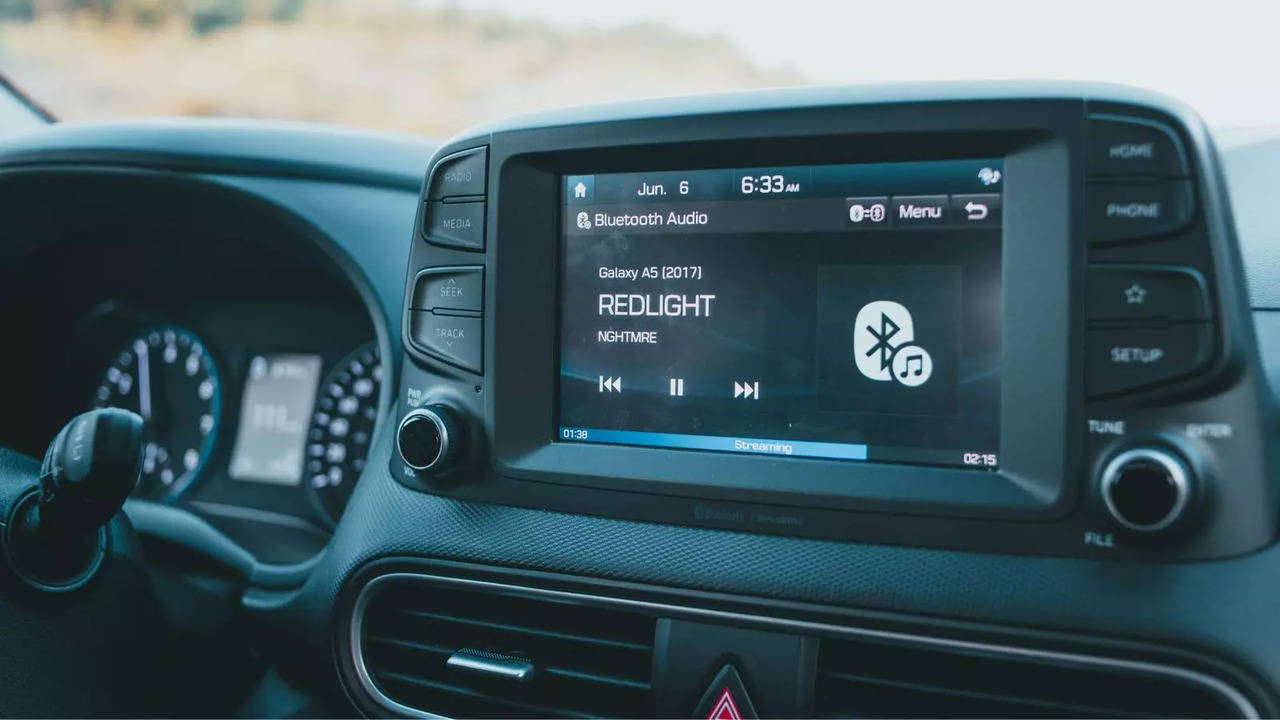

Global infotainment system sales for passenger vehicles reached 105 million annually, growing at a 3% CAGR from 2025-2035, with Southeast Asia, North America, and MEA as key growth markets. Automakers like Tesla are integrating systems to control supply chains, challenging traditional suppliers and potentially leading to industry consolidation as the sector shifts toward software-defined vehicles.