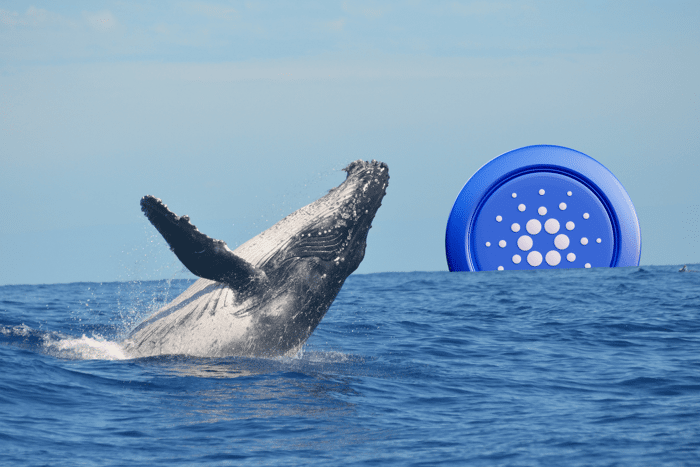

Cardano Whales Accumulate 50M ADA in Just Two Days — Another Rally Cooking?

- 20.03.2025 06:45

- fxempire.com

- Keywords: Cardano, Whales, Coinbase, Amina Bank

Cardano whales accumulate over 50M ADA in two days amid a 20% YTD drop. Technical indicators hint at bullish potential as Coinbase introduces futures and Amina Bank integrates staking.