BofA’s Five-Star Analyst Explains Why Nvidia Stock (NVDA) Has Been Falling

- 24.03.2025 10:50

- markets.businessinsider.com

- Keywords: AI, Market Growth

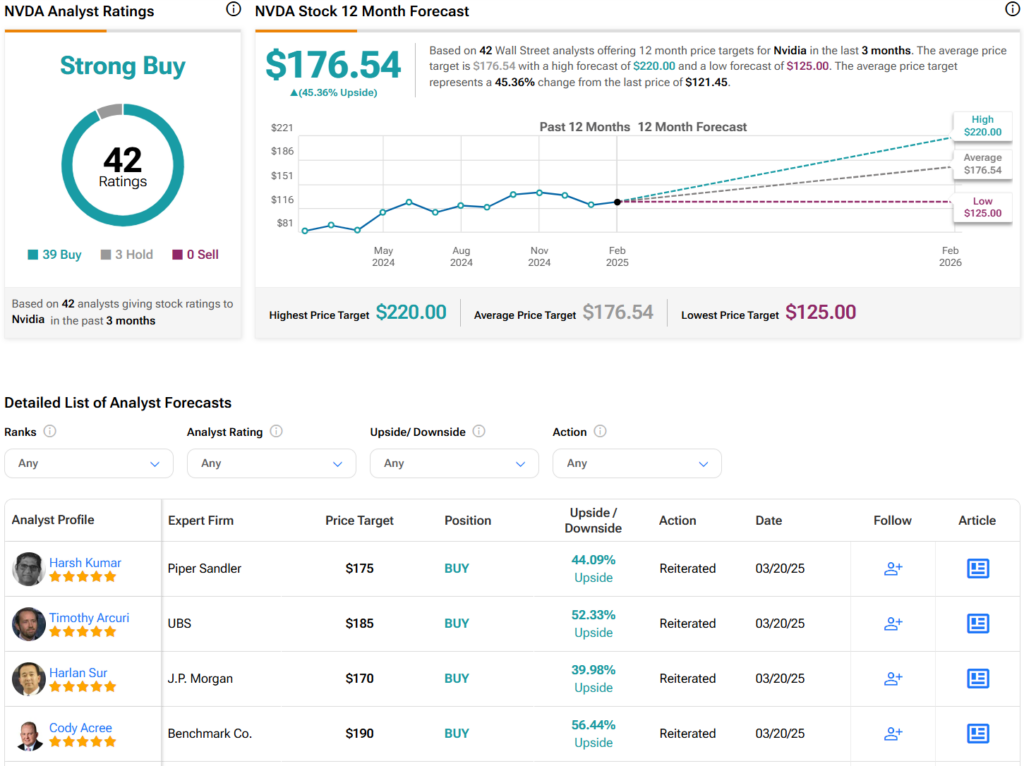

Nvidia stock has declined due to investors shifting funds from large-cap names like NVDA to international markets. Despite this, Bank of America's five-star analyst remains bullish, citing strong fundamentals and a $200 price target. Nvidia's recent product launches and AI advancements have not yet boosted investor confidence, as they await real-world applications driving demand.